what is the income tax rate in dallas texas

This is the total of state and county sales tax rates. Middle-income earners should feel a little bump in their checks when.

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

For instance an increase of.

. SCHOOL DISTRICTS 70 -100 Disability. What is the sales tax rate in Dallas County. However revenue lost to Texas by not.

Sales Tax Calculator Sales Tax Table. The average cumulative sales tax rate in Dallas Texas is 825. This includes the rates on the state county city and special levels.

The current total local sales tax rate in Dallas TX is 8250. As of the 2010 census the population was 2368139. The Texas sales tax.

What is the sales tax rate in Dallas Texas. The current total local sales tax rate in Dallas TX is 8250. Texas does not have an individual income tax.

Texas is one of seven states that do not collect a personal income tax. 1 2 3 4 State mandated exemption is 10000. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose.

The average yearly property tax paid by Dallas County residents amounts to about 43 of their yearly income. 100 rows Dallas County is a county located in the US. Only the Federal Income Tax applies.

- Single standard deduction one exemption. The CFED chart is s based on 2007 data from the Institute on Taxation and Economic Policy and theres more. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example.

Dallas County is ranked 167th of the 3143 counties for property taxes as a. This marginal tax rate means that your immediate additional income will be taxed at this rate. Texas does not have a corporate income tax but does levy a gross receipts tax.

The Texas Franchise Tax. Texas state income tax rate table for the 2022 - 2023 filing season has zero income tax brackets with a TX tax rate of 0 for Single. Texas has no state income tax.

If you make 70000 a year living in the region of Texas USA you will be taxed 8387. This marginal tax rate means. They can either be taxed at your regular rate or at a flat rate of 22.

Four states impose gross receipt taxes Nevada Ohio Texas and Washington. Excess exemption value reported is a local jurisdiction option. Texas Income Tax Rate 2022 - 2023.

The December 2020 total local sales tax rate was also 8250. 2020 rates included for use while preparing your income tax deduction. New employers should use the.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Dallas Texas is. Your average tax rate is 169 and your marginal tax rate is 297.

If your normal tax rate is higher than 22 you might want to ask your employer to identify your supplemental wages. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas. Texas has a 625 percent state sales tax rate a max local sales.

2022 Tax Rates Estimated 2021 Tax Rates. The minimum combined 2022 sales tax rate for Dallas County Texas is. Your average tax rate is 1198 and your marginal tax rate is 22.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Rates include state county and city taxes. It is the second-most populous county in Texas.

Dallas is located within Dallas County Texas. - Sales Tax includes food and services where. Currently Texas unemployment insurance rates range from 031 to 631 with a taxable wage base of up to 9000 per employee per year.

Why Are People Moving To Texas Moving To Texas Texas Quotes Texas Life

Affordable Auto Insurance Dallas Texas Get The Best In Car Insurance Quotes Today 50 Discounts On All I Cheap Car Insurance Car Insurance Low Car Insurance

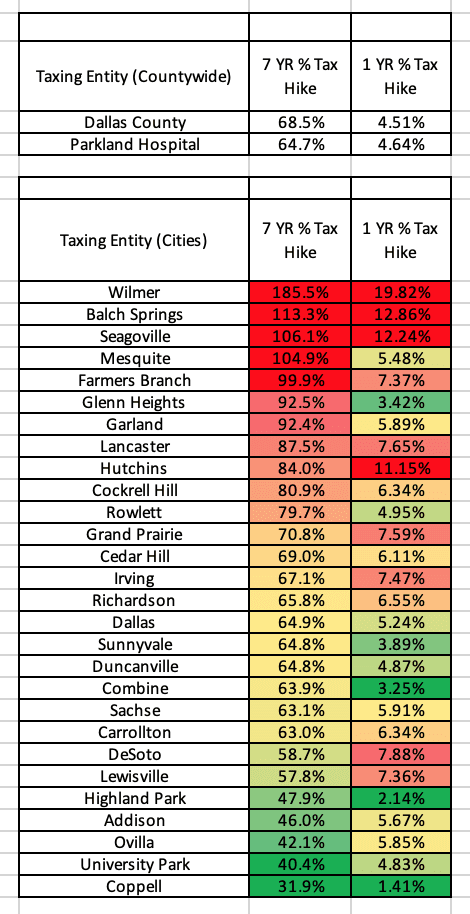

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Bobby M Collins Education Annuities Specialist In Dallas Fort Worth North Texas Retirement Particularly In North Texas And The Da In 2022 Annuity Retirement Collins

Texas Busy Practice Just Outside Of Dallas Seeking A Dermatologist High Earning Potential Forney Tx Texas Jobs Dermatology Job

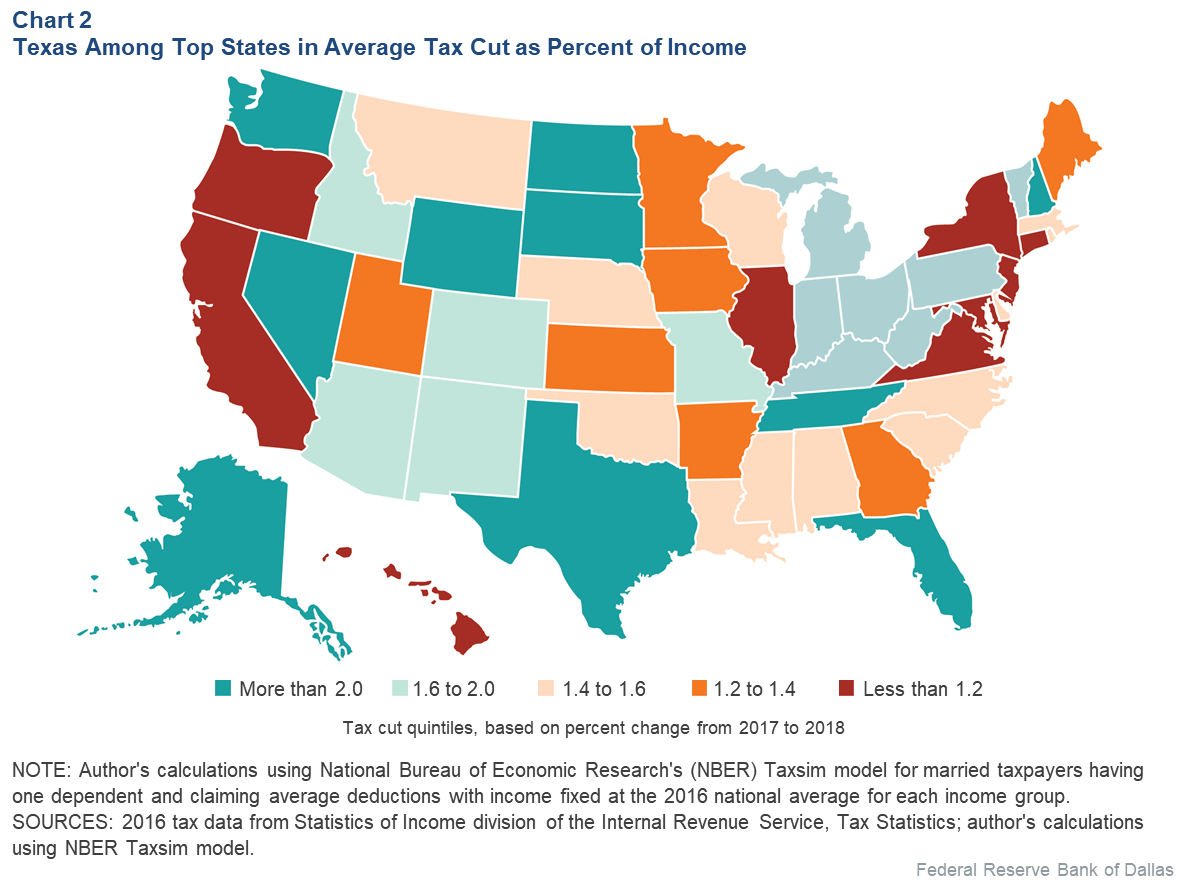

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

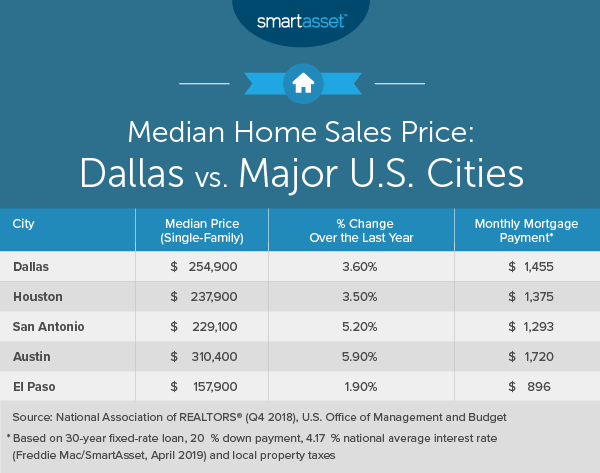

Cost Of Living In Dallas Smartasset

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Where Do My Taxes Go H R Block Consumer Math Business Leader Financial Planning

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Living In Dallas Everything You Need To Know Cool Box

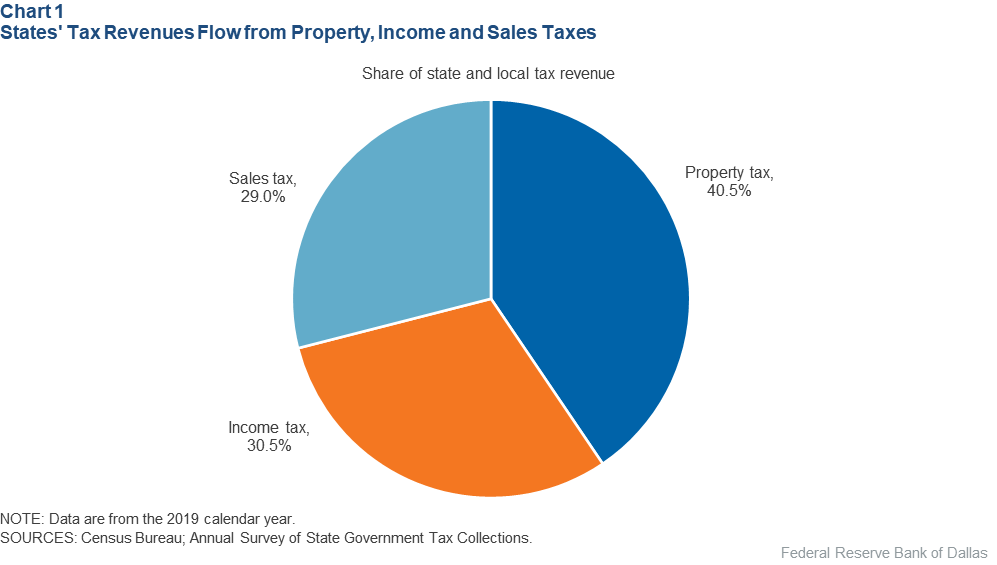

Federal Support Keeps State Budgets Including Texas Healthy Amid Tumult From Covid 19 Induced Economic Ills Dallasfed Org

Dallas Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Bookkeeping Business Plan Template Google Docs Word Apple Pages Template Net In 2022 Bookkeeping Business Business Launch How To Plan

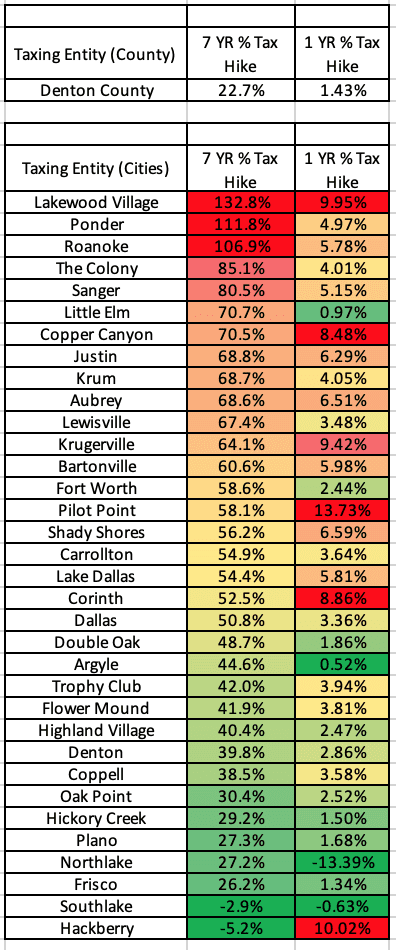

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Tax Rates Richardson Economic Development Partnership

Here S How Much Money You Take Home From A 75 000 Salary

Dallas Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Businesses Likely To Get Advance Tax Reduction Irs Taxes Tax Debt Tax Reduction